- Lowpass

- Posts

- What Netflix's Warner Bros. deal could mean for TVs and remotes

What Netflix's Warner Bros. deal could mean for TVs and remotes

Also: Zuck wants you to jump into videos

Hi there! My name is Janko Roettgers, and this is Lowpass. This week: Smart TV implications of Netflix’s WB deal, and Mark Zuckerberg’s new vision for immersive videos.

Netflix’s Warner Bros. acquisition puts a spotlight on its deals with TV makers

If you’re in the market for a new TV, you’ll have plenty of different options these days, ranging from display technologies (OLED vs. QLED vs. micro RGB) to styles (shiny home theater displays vs. matte art TVs) to operating systems (Roku vs. Google TV vs. Tizen vs. Fire TV).

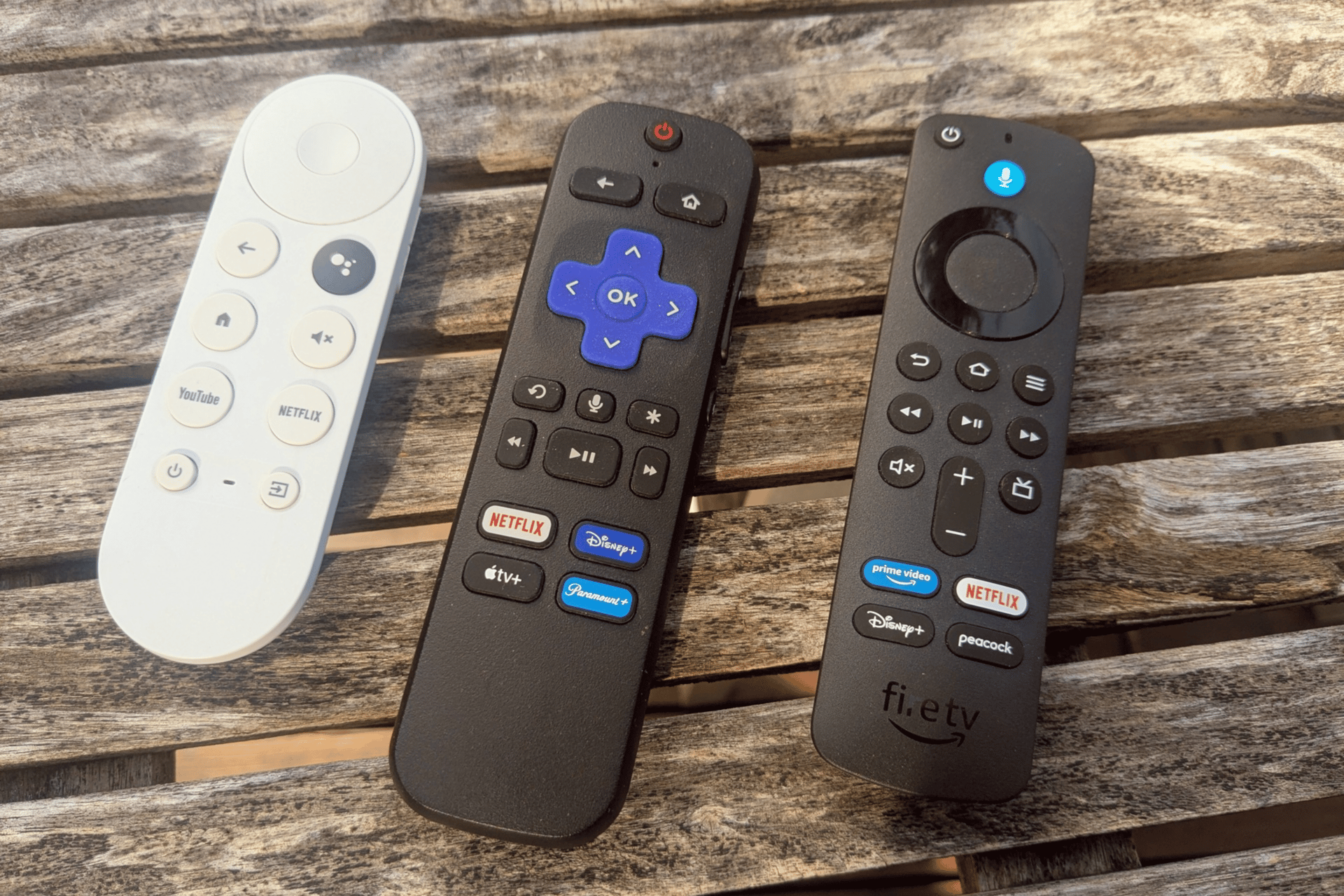

However, you’ll find that all these different TVs still have something in common: Every TV comes with a remote that has a Netflix button, and most will feature the Netflix app prominently placed on the homescreen, usually in the first spot of the TV’s homescreen app rail.

That’s no accident: Netflix has long forced TV makers and smart TV platform operators to follow strict guidelines if they want to ship their devices with its app. A lot of these rules are technical in nature, and meant to ensure that Netflix runs without hiccups on any device certified by the company. Others seem more designed to cement the company’s market position, and prevent Netflix content from drowning in a growing sea of streaming titles from other services.

Device makers have little choice but to accept those terms. Netflix is responsible for 19 percent of all streaming in North America, and its app is the second-most-popular app on smart TVs after YouTube. That makes the Netflix app a must-have, as shipping a device without it would be commercial suicide.

Now, some smart TV industry insiders are wondering what this all means for Netflix’s acquisition of Warner Bros. and its HBO Max service. Will Netflix extend its requirements to the HBO Max app and its content, perhaps through an HBO-branded remote control button? Or could regulatory pressure, and Netflix’s desire to get the deal done despite a competing bid from Paramount Global, force it to ease up on some of its policies, and for instance give TV makers more access to its data?

Netflix declined to comment on specific aspects of integrating the two services when contacted for this story.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • A full-length newsletter every week

- • No ads or sponsorship messages

- • Access to every story on Lowpass.cc

- • Access to a subscriber-only Slack space and subscriber-only events

Reply